Content

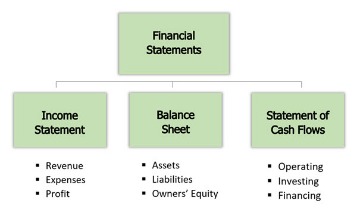

Anyone on a private school’s leadership team and board of directors should have knowledge regarding the financial oversight of their school. In addition to addressing funding and expenditure challenges, there is a legal and professional responsibility for a school’s leadership team and board to protect their school’s assets. This includes overseeing the school’s financial activities and implementing policies and procedures to protect the organization. In all three cases, the auditor begins with the account balances provided by management, but an audit requires in a significant amount of corroboration of this information. A review requires some testing of the information, while a compilation almost entirely relies on the presented information. An equity statement can show you whether the value of the company has grown over time – but that is not the only method of measuring results. The cash flow and tendencies connected to it can clearly showcase if the company is growing at a steady rate or if there are problems that need to be addressed by a change of strategy.

- An equity statement can show you whether the value of the company has grown over time – but that is not the only method of measuring results.

- A compilation involves taking the client’s existing financial information and compiling it into financial statement formats.

- Find out everything you need to know about financial statement audits with our definitive guide.

- If the financial statements omit notes, the financial statement titles should include the special purpose framework; for example, Statement of Revenues and Expenses—Tax Basis.

- “The wide selection of frameworks is very useful to me as an independent consultant. In fact, it rivals what I had at my disposal at Big 4 Consulting firms in terms of efficacy and organization.”

A percentage used to determine the amount ofDEPRECIATIONto be recorded eachACCOUNTINGperiodfor the straight-line method. ACCOUNTINGmethod that reflects an equal amount of wear and tear during eachperiodof anASSET’S useful life. For instance, the annualSTRAIGHT-LINE DEPRECIATIONof a $2,500 asset expected to last five years is $500. Organized marketplace in which stocks,COMMON STOCKequivalents, and bonds are traded by members of the exchange, acting both as agents and principals. This sets out theperiodwithin which actions may be brought upon claims or within which rights may be enforced. As it pertains totaxreturns, thestatute of limitationsis generally three years from the date a return is due or filed.

Analytical Procedures

Some bases of Ultimate Guide To Financial Statement Review And Compilation (e.g., tax-basis) do not require the issuance of a cash flow statement. If I had a business, I would probably need help with my financial statements. I’d be pretty new at everything so going with a CPA would for sure help me out. As you said here, there are three basic types of financial statements. Determining which one to go with would all depend on the level of detail I wanted in the report. It might be a good to go with a compiled one since it’s the least expensive of the lot. It is better than the balance sheet because it shows the results for a period of time and not at a specific date.

What should I look for when reviewing financial statements?

What are some things you look for in financial statements as an investor? When analyzing financial statements, investors should consider reviewing a company's net profit, sales and revenue growth, debt level, profit margin, and free cash flow.

A https://intuit-payroll.org/line for the process should be established, leaving adequate time for budget research, review and feedback. Finally, be prepared to document everything along the way, as good documentation will ensure that each participant understands his or her responsibilities and deadlines. Audited financial statements may be required when raising equity, planning to sell, receiving funding from federal or state governments, or looking for extended credit or significant financing.

Protecting Nonprofit Nonpartisanship

Contact us or instantly book a meeting to discuss how we can provide your company with the accounting expertise you need to make your financial statement audit as painless as possible. G-Squared helps companies get ready for and get through a financial statement audit. We act as our client’s finance team, handling the interactions with the auditors and making the process as painless as possible. In other words, you can continue to run your business while we handle the audit for you. A financial statement audit also has a higher materiality threshold – in other words, the financial statements are expected to be materially correct.

Financial statements reflect vital information regarding the financial health of the association. Because it is so essential to understand the financial aspects, an HOA should consider an audit. This ensures that the new board members do not inherit financial issues and it’ll rule out the possibility of mishandling funds.

Concentrate Internal Controls on Your Biggest Risks

The request is because either a third party is asking for one of these services or leadership may feel like a CPA firm is needed to examine their records. Finally, having good record keeping and detailed financial statements will help the management itself, which will have a clearer picture of their successes or mistakes and will be able to act accordingly. Every business owner knows the value of keeping their investors and shareholders satisfied. There’s no better way to do just that than by having perfect record keeping. Your income statements and shareholders’ equity statements will prove you’re keeping the business on the right path. It will be much easier for these investors to trust you with their money – and future money – rather than try to sell or liquidate their assets.