Contents

To understand the risks and costs involved, please visit the section captioned “Important Information” and the “Risk Disclosure Statement”. When you’re trading a futures contract via CFDs, like Sugar No.11, you’ll need to decide on the quantity of the commodity to buy or sell in advance of the expiry. Alternatively, you can practise trading sugar with a demo accountand apply your strategy risk-free. For example, in 2018, the UK government introduced a tax on the producers of soft drinks which contained sugar above a certain threshold.

It can stimulate economic growth, potentially reducing poverty and its detrimental health impacts, promote investments in health care, education, and other population health determinants, and increase access to life-saving goods and technologies [10–12]. However, such health gains are not automatic and depend on progressive public policy for equitable distribution throughout society. Yet few studies have been able to provide quantitative relational evidence of these effects. Other factors that may contribute to a country’s investment climate include political and economic stability, infrastructure, wages, corporate tax structures, tax incentives for FDI and proximity to main markets . To our knowledge there were no considerable changes in these factors in Vietnam during our intervention period. Deciding where to introduce the time of intervention is also complicated.

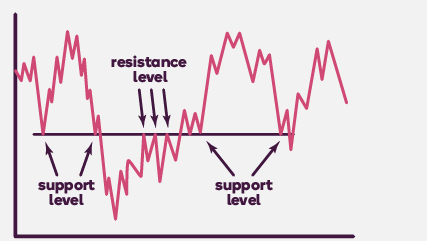

The best strategy to use when trading sugar is going to depend on whether the market is trending, or if it is range-bound. In a trending market the various oscillators are often best at locating potential zones where pullbacks could occur, and areas where a trend could either continue or reverse. When the market is range-bound it is usually best to locate the areas of support and resistance and trade based off of moves from those levels.

- We also conducted a series of sensitivity tests to see whether our results are robust to different model specification.

- IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority.

- The Sugar No. 11 contract is the world benchmark contract for raw sugar trading.

Options are also a derivative instrument that employ leverage to trade in commodities. However, options also have a strike price, which is the price above which the option finishes in the money. Between 74-89% of retail investor accounts lose money when trading CFDs. In a range trading strategy, a trader will identify levels of support and resistance in an asset’s price movements and seek to buy at levels of support and sell at levels of resistance. Range strategies work best in markets with lots of price movements, where there is not any particular long-term trend.

Our study is intended to sit alongside a similar analytical approach focusing on Peru, the second ‘least wealthy’ TPP nation . These two papers contribute to the body of quantitative evidence exploring the diet-related health effects of trade and investment agreements by providing robust evidence for the link between investment liberalization and changes to the food environment, namely SSCBs. The findings have implications for how increased trade and investment liberalization commitments in the TPP will likely continue affecting health-harmful diet-related changes, and should be utilized by health and trade ministries to make informed policy decisions.

Should I Trade in Sugar?

The observed rise is so large that it is very unlikely to be explained by the pre-intervention data alone. Over the intervention period per capita sales of SSCBs rose by 2 l annually in Vietnam. Nutrition information provided by Coca-Cola,Footnote 1 which distributes the top selling SSCB in Vietnam (Coca-Cola, 22 % of market share) reports 39 g of sugar in 12 fluid ounces. Thus 2 l of Coca-Cola would potentially introduce approximately 220 g of added caloric sugar per capita per year into the Vietnamese diet wholly from SSCBs. This is not a dramatic increase, although Euromonitor predicts that consumption will rise by another 7 l per capita per year by 2019, which could introduce another 770 g of added sugar. Sugar is an interesting commodity, and because there are so many uses for it the price of sugar can become quite volatile.

A randomized controlled trial of national trade policy and population dietary outcomes would be inconceivable, thus we made constructive use of naturally occurring conditions in Vietnam and the Philippines to help estimate such effects. Natural experiments can yield valuable evidence where it would be otherwise unattainable. Future analyses of this nature could be strengthened by excluding alternative explanations, including a wider range of falsification tests, or the use of a synthetic control , rather than a single control country. Additionally, there may have been one or more significant events that took place in Vietnam that may equally or better explain our findings that were outside of the knowledge and control of the researchers.

Contracts for Difference (CFDs)

That type of strategy can also reveal the beginning of a new trend when price breaks through support or resistance rather than bouncing. There are virtually no pure-play global public companies engaged in the production and sale of sugar. Imperial Sugar was a public company before being acquired and taken private in 2012. You can trade sugar using a wide range of financial instruments, including futures, CFDs. Sugar can be used to produce ethanol – a chemical compound that can be used as an alternative to fossil fuel. The demand for ethanol is on the increase, which could mean higher sugar prices in future.

The contract prices the physical delivery of raw cane sugar, free-on-board the receiver’s vessel to a port within the country of origin of the sugar. Sugar futures on ICE retreated to 19.7 cents per pound from the near three-week-high of 20.1 cents touched on January 17th, amid expectations of strong supply. Policymakers of the world’s top producer, Brazil, confirmed the extension of a program that exempts fuel from federal https://forexhero.info/ taxes, encouraging producers to allocate sugarcane for more-profitable sugar crushing instead of ethanol blending. In the meantime, fair weather and adequate soil conditions in Brazil’s center-south region further supported the incoming crop. Among other news, major producer India will not allow a second triage of exports to shield its citizens from soaring food inflation, thus, limiting the commodity’s price decrease.

Risks of Trading in Sugar

All trading involves risk, especially if you’re trading using leverage, which is why you need a risk management strategy to protect against unnecessary losses. There are ways in which you can minimise your risk, which includes attaching stops to your positions. Stops will close your trade at a certain point if the market moves against you, to prevent you losing more than you’re prepared to. Sugar is part of the common market organisation between EU countries, which has several functions including providing a safety net to agricultural markets, cooperation through producer organisation and inter-branch organisations, and laying down minimum quality requirements.

Beet farmers can get income support in the form of direct payments that are largely decoupled. EU countries have also the possibility to grant voluntary coupled support to specific swissquote forex broker review sectors in difficulty – including sugar beet and sugar cane production. Eleven EU countries have decided to grant voluntary coupled support for sugar beet producers.

Secular Cotton Bull Continues, Defines New S-T Risk

We also conducted a series of sensitivity tests to see whether our results are robust to different model specification. Changes in sugar-sweetened beverages may have been linked to changes in economic growth. To test this relationship we adjusted our models for GDP, finding that our results did not qualitatively change. Next, we included a linear time trend in the model to test whether the observed increase in sugar-sweetened beverages is consistent with the background trend.

Sugar trading in summary

The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. 75% of retail client accounts lose money when trading CFDs, with this investment provider. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money.

Of course weather can also impact sugar prices, especially in Brazil and India, where roughly half the world’s sugar cane crops are grown. The Sugar No. 11 contract is the world benchmark contract for raw sugar trading and is available on The Intercontinental Exchange . The biggest producer and exporter of sugar in the world is Brazil (21% of total production and 45% of total exports). A significant amount of sugar is also produced in India, European Union, China, Thailand and the United States. The sugar prices displayed in Trading Economics are based on over-the-counter and contract for difference financial instruments. Sugar No.11 is a futures contract for the physical delivery of raw cane sugar.

Ethanol demand

The other category, while in flux during this period, held 9.4 % of market share in both 2004 and 2013. Difference-in-difference models were used to test pre/post differences in total importance of sdlc SSCB sales and foreign company penetration covering the years 1999–2013. There are, of course, other sugar futures such as white sugar futures and containerized white sugar futures.

Comparing SSCBs with unprocessed food in Vietnam and the Philippines

On the NYSE traders interested in sugar might want to look into companies like HSY, CSAN and TR. An options bet succeeds only if the price of sugar #11 futures rises above the strike price by an amount greater than the premium paid for the contract. In this guide to trading sugar, we’ll explain how and where you can trade this popular commodity with a list of regulated brokers that are available in your country. We also discuss why some traders choose to trade sugar and what experts say about trading it. Sugar is often traded using futures – contracts in which you agree to exchange a set amount of the underlying commodity at a set price on a set date. These contracts are traded on futures exchanges, such as the Intercontinental Exchange .

The Sugar No. 11 futures contract is considered the benchmark for trading raw sugar around the world. Sugar production is concentrated in tropical and subtropical areas, so the performance of Sugar No. 11 can also be used as an economic data point for countries that are heavy producers. The two sugar futures markets that are traded include world sugar No.11 and U.S. sugar no. 16.