Content

It’s also a good idea to watch your P&L statements over time to help you understand how your business is developing. Subtract operating expenses from business income to see your net profit or loss. If revenues are higher than total business expenses, you’re making a profit. If your business expenses over the period being examined were higher than your income, the company has made a loss. On the other hand, a balance sheet is another important financial report to report a business’ assets, liabilities, and shareholders’ equity. Combining the balance sheet with the P&L statement gives you a good overall snapshot of a company’s financial health.

- First, find your gross profit by subtracting your COGS from your gross revenue.

- The best way to find out is to create a profit and loss statement.

- An up-to-date profit and loss statement helps you keep an eye on your business’s financial health so you can identify cash flow issues before they become a problem.

- On the other hand, large, publicly-traded companies with extensive product lines have long profit and loss statements.

- The cost of goods sold is the amount you spend on materials to operate your business.

- Your OPEX are all the indirect expenses incurred when running the business.

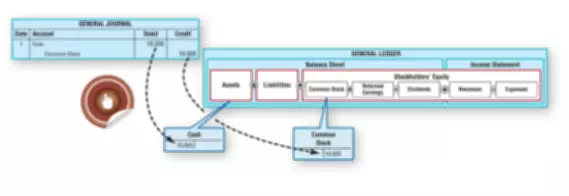

Company managers and investors use P&L statements to analyze the financial health of a company. An income statement is one of the three major financial statements that report a company’s financial https://www.bookstime.com/ performance over a specific accounting period. The three most important financial statements of any business are the cash flow statement, balance sheet, and profit and loss statement.

Example of a Profit and Loss (P&L) Statement

Since your indirect expenses are fixed, and the cost of goods sold is variable based on how much you sell. For business owners, calculating profit isn’t quite as easy as fishing a $50 bill out of the gutter. Running a business costs money—from marketing and material expenses to wages and investments in machinery. With cash constantly flowing into and out of your accounts, it’s tough to tell at a glance exactly how much money you’re making.

It clearly shows how your business generates money , how it spends it and what remains after all the costs are accounted for . By analyzing the statement, you can get a better view of your firm’s profitability and so much more. Abbreviated as EBIT, earnings before interest and taxes shows the company’s profit including all incomes and expenses, but less income tax and interest expense. There are several ways of calculating EBIT, but the most straightforward is to subtract cost of goods and operating expenses from revenue. Also known as indirect costs, operating expenses are all the costs that a business incurs during normal operations. They include things like office supplies, payroll, marketing, insurance, administrative costs, rent etc.

How to read a profit and loss statement

If you don’t feel ready to tackle it yourself, we highly recommend considering online accounting solutions like Quickbooks or Sage Business Cloud Accounting. Both can simplify the process and guide you through the steps we discuss below. These include cost of goods sold, payroll expense, insurance, taxes, rent and interest profit and loss examples on business loans. As previously mentioned, you can prepare a monthly, quarterly or annual profit and loss statement. The problem with monthly statements is that you probably won’t have enough data to yield a meaningful statement. Annual P&Ls, on the other hand, might have you digging for data as far back as 11 months ago.

Is profit and loss debit or credit?

All the expenses are recorded on the debit side whereas all the incomes are recorded on the credit side. When the credit side is more than the debit side it denotes profit. Hence, Credit balance of Profit and loss account is profit. Was this answer helpful?

During the month of June-2019 Company generated revenue by selling the garments of $ 100,000, when the cost of goods sold was $ 60,000. Along with this, the Company generates income from selling the waste material left after making the garments worth $ 9,000 and an interest income of $ 4,000. It is important to compare P&L statements from different accounting periods, as any changes over time become more meaningful than the numbers themselves. Each entry gives specific insight into the cash flow of the company and paints a comprehensive picture of where money is coming from and how it is used. The P&L statement is unique in its ability to provide a comprehensive context for assessing financial fitness. A P&L statement shows a company’s revenue minus expenses for running the business, such as rent, cost of goods, freight, and payroll. Suppose we’re creating a simple profit and loss statement for a company with the following financial data.

How do you prepare a profit and loss statement?

The cash flow statement is another financial document that monitors cash flow in and out of the business, sufficient funds for bills, and how well the business generates money. Additionally, a P&L statement is necessary to prove that your business is a trustworthy, solid investment. Essentially, the profit and loss statement showcases your ability to identify complex business problems and articulate how you solved them from a financial standpoint. A P&L showcases a company’s income and expenses over a certain time period.

- Are you invoicing clients overseas, or working with suppliers based abroad, but waiting around for slow international transfers to finally reach your account?

- An income statement is basically a table with rows and columns created on a spreadsheet.

- Salaries of people in administrative roles are not directly related to revenue, so they are included as fixed expenses.

- The P&L statement is often generated by computer accounting software or by entering figures on a P&L statement template.

- The spending of the company on the rent was $6,000, on utility was $5,000, and on the salary of one staff working was $7,000.

Just plug in revenue and costs to your statement of profit and loss template to calculate your company’s profit by month or by year and the percentage change from a prior period. The best way to prepare a profit and loss statement is to present all your business revenues and expenses on a spreadsheet. As mentioned, there are several spreadsheet applications that you can use, including Microsoft Excel, Google Sheets, EasyCSV and Smartsheets. Choose one that you’re most comfortable with and follow the following steps to prepare a P&L statement. At the same time, an income statement shows production and operation expenses in detail over a period of time, thus revealing where costs are going.

“An audit is usually performed when a bank wants to lend a large amount of money, or a company is being acquired. Additionally, investors require an annual audit to assure their investment is being properly reported,” says Armine.

On the other hand, large, publicly-traded companies with extensive product lines have long profit and loss statements. An up-to-date profit and loss statement helps you keep an eye on your business’s financial health so you can identify cash flow issues before they become a problem. A single-step profit and loss statement is a bit more straightforward. It adds up your total revenue, then subtracts your total expenses, and gives you your net income. Operating earnings are sometimes called operating profit or operating income. Once you take into account all internal costs, you get your operating earnings. It’s a measure of how profitable your business is, without taking into account external costs, like interest payments, taxes, depreciation, and amortization.

Expenses

If your profit and loss statement for a small business shows a profit, then it means that your company recorded far more revenues than costs. But if you made a loss, it means that your costs exceeded revenues and you need to evaluate your business model so that it becomes profitable. The difference between EBIT and EBT is that the latter includes interest expense while EBIT deducts it.

- With cash constantly flowing into and out of your accounts, it’s tough to tell at a glance exactly how much money you’re making.

- Revenue and expenses are shown when they are incurred, not when the money actually moves, and the statement can be presented in a detailed multi-step or concise single-step format.

- We’ve created a simple profit and loss statement template for you to use here.

- You sell products, your expenses will include the cost of wholesale products and any shipping-related expenses.

- Look up what an average profit margin is for your industry and use the P&L reports you’re running to understand how you stack up.

- Together with the balance sheet and the cash flow statement, the income statement provides an in-depth look at a company’s financial performance.

In other words, your business does not record the income or payout until it gets made. For example, perhaps an investor looks at your profit and loss statement and sees that your profits were limited for the quarter. If they look closely at the data, they can see whether your overall profits were limited because of uncontrolled expenses or lagging profits or because you reinvested earnings to grow your business. Operating profit is the total your business gets after deducting COGS and additional expenses. You’ll need to calculate your gross profit, minus what you spent on rent, salaries, admin fees, etc. Before calculating your total income, determine the time frame you’re calculating for.