Content

Crypto currencies can cause some discomfort during their early stages of adoption. It is easier for the people to change their currency in any country’s national currency than in many other countries. As a result, cryptocurrency exchanges and exchange houses with a specific focus on crypto-currencies were required.

Order books, aggregations tools, and liquidity providers are the most well-known Defi mechanisms. Various decentralized platforms employ these mechanisms to facilitate trading. Regardless of how legitimate a company is, centralized entities always carry an inherent risk of fraud. In fact, the users do not even fully own digital wallets on the exchange. The term ‘centralized’ in centralized crypto exchange hints towards the fact that an intermediary or a third party is involved. Users are unaware, leading to multiple attempts to fill the same order and network-level failure for all but the first trade to mine successfully.

What Is The Difference Between Centralized And Decentralized In Crypto?

While cryptocurrency can be intimidating, especially regarding wallets and seed phrases, the OpenSea platform is as intuitive as you can hope for within the space. For (on-chain) DEXs, since everything can be traced on the blockchain, it’s https://xcritical.com/ next to impossible to commingle funds without raising attention. That’s exactly what FTX (off-chain CEX) reportedly did when it loaned out half of its customer funds to its sister company Alameda Research in an effort to fund risky bets.

- In either of these cases, users can get stripped of all their digital assets.

- An introduction to cryptocurrencies and the blockchain technology behind them.

- On common bitcoin trading, $100 can be exchanged for an estimated value of digital currency, including vice versa Similarly, a bitcoin worth $100 may be exchanged for an equal quantity of Litecoin.

- On the other hand, some users may prefer the privacy and quick-swapping of digital assets offered by decentralized exchanges.

It is one of the great boons for which people shift to decentralized exchanges. These crypto exchanges provide the required privacy as it does not take hold of the user’s tokens, unlike centralized exchanges. Trading fees on crypto transactions are yet another major concern with centralized cryptocurrency exchanges. Other than that, you can expect to pay other forms of crypto exchange fees such as inactivity fees, service charges, and a lot more.

WHAT ARE CENTRALIZED EXCHANGES (CEXs)?

Centralized exchanges are operated by companies responsible for their customers’ holdings. Large exchanges usually hold billions of dollars worth of bitcoin, making them a target for hackers and theft. No wonder entrepreneurs rush to get DeFi development solutions and join this growing crypto economy. As more people enter the digital asset space, DeFi will increase its capabilities and become very robust in terms of security. So Defi development solutions get millions of users in this digital era, and in the future, it grows with more users.

Risk — it is difficult to verify that a new exchange is legitimate, and when they were first launched headlines were dominated by investors claiming to have been scammed. Consistency of vision — the founders and developers of these exchanges’ goals are aligned with the goals of the entire DeFi movement. Some first-generation decentralized sites or apps that employ order books are Tomo DEX, dYdX, Binance DEX, Nash Exchange & Vitex.

Liquidity — it’s easy to find buyers and sellers on an exchange with millions of users. Liquidity — without many users regularly logging onto an exchange, it can be difficult to find people to sell to or to buy from. Increasing popularity — with continued development and a move towards incorporating fiat currency pairings these exchanges may one day become the most popular. Whilst Blockchain development does typically have “leaders”, this only slightly lessens the decentralized nature of the exchanges as developers and miners maintain power and say.

On the other hand, carrying out peer-to-peer transactions can be difficult. All that you have to do on centralized cryptocurrency exchanges is log into their accounts, deposit funds using fiat currency, and purchase their preferred coins. Crypto trading on centralized exchanges is sometimes a days-long lengthy process. As soon as someone decides to buy crypto or exchange Bitcoin or any other currency, he/she needs to approach centralized exchanges like Coinbase or Binance. Traders often face the choice between centralized and decentralized exchanges when they first start investing in crypto. In this article, we will have a closer look at what centralized crypto exchanges are and we will also understand the pros and cons of investing via these exchanges.

Centralized exchanges offer higher comfort levels by facilitating transactions through a developed, centralized platform. In addition to the regular gas fee, there will be a one-time additional fee for first-time sellers. Note that, as with all gas fees, this fee varies with time depending on how congested the blockchain is. Elsewhere, the world’s biggest cryptocurrency exchange, Binance, launched its own NFT marketplace in June 2021 to sell digital artworks and collectibles. Not to be outdone, Coinbase followed suit in May 2022 with its own iteration. Decentralized exchanges may not ask consumers to fill out understand applications, allowing users to maintain their privacy and confidentiality.

Resources

These platforms allow users to store their own assets, reduce transaction fees, and avoid regulatory scrutiny. Decentralized exchanges, like centralized exchanges, are also vulnerable to liquidity risks. Cryptocurrency exchanges allow users to buy and sell currencies quickly and easily. Through a centralized exchange, you can gain access to your cryptocurrencies and be kept in the dark as a custodian.

Although centralized exchanges own the leading position in the market, the decentralized crypto exchange is also fast approaching people with its peculiar perks. While CEX is an authorized exchange type to buy and sell your tokens, DEX is a non-custodial trading site. Regardless of high security, centralized cryptocurrency exchanges are always at risk of getting hacked or breach. Centralized cryptocurrency exchanges are backed up by companies that hold their customers’ funds. The following are the top centralized cryptocurrency exchanges, according to traffic, liquidity, and trading volumes. Due to their nature of allowing for the peer-to-peer exchange of cryptocurrencies, decentralized exchanges prevent market manipulation, protecting users from fake trading and wash trading.

It allows investors to reap higher returns, but losses can also be amplified. There are Centralized and Decentralized Cryptocurrency Exchanges, and each offers advantages and disadvantages. The first step required to buy an NFT is to obtain the cryptocurrency necessary to purchase it. This means opening a crypto wallet, for which there are many options on the market. A few include MetaMask, Coinbase Wallet, Phantom and TrustWallet, to name several examples. The market strength that OpenSea possesses means that it has pricing power when it comes to fees.

Coinbase:

The emergence of cryptocurrencies as a new form of money has had a massive impact on societies around the world. We have seen cryptocurrencies produce +10,000% returns over the last several years, and some continue their climb. Since governments do not centrally control cryptocurrencies, one of the most significant results of the blockchain craze has been the decentralization of money issuance. One of the other benefits of certain CEXs is the option to leverage your investments using borrowed money from the exchange, called margin trading.

In centralized exchanges, all accepted networks are already configured which eliminates issues of having to configure wallets manually for a particular network. This has also helped to accommodate newbies who are new to the blockchain space and do not know how to go about configuring wallets. While blockchain tech does wonders for the worlds of business and governance, in terms of transparent recordkeeping, it is still up to exchanges and their users to protect valuable data and funds. At Hacken, we want to ensure the highest level of security and for all parties of good nature.

Centralized exchanges form a majority of the transactions taking place in cryptocurrencies and are seeing a strong increase in both institutional and retail participation worldwide. Binance is the biggest cryptocurrency exchange based on the average daily volumes being traded. It provides hundreds of currencies for trading and charges relatively lower fees than other commonly used exchanges. It also provides advanced charting systems without the user having to upgrade. Cryptocurrencies have recently become asset classes attractive to a lot of the investors that have been fascinated by the splendid returns provided by the same.

Cons OF CENTRALIZED EXCHANGES

Centralized exchanges are typically more liquid than decentralized exchanges, and they also tend to offer more features and be more user-friendly. However, centralized exchanges are also more vulnerable to hacks and single points of failure. A decentralized exchange is a type of cryptocurrency exchange where trade orders are matched by decentralized software, typically on a blockchain. Decentralized exchanges tend to be less liquid than centralized exchanges, but they are also much more resistant to hacks and single points of failure.

Comparison of features of CCE and DEXv

They provide a platform wherein investors can buy cryptocurrency using fiat currency. Alternatively, they can also convert one type of cryptocurrency into another. These are licensed corporations fast crypto exchange that have a physical presence i.e., offices, employees, and other such infrastructure. Centralized exchanges are trading platforms that function like traditional brokerage or stock markets.

List of some famous DEX:

It makes them less convenient for users that do not already hold cryptocurrencies. Popular Crypto Exchanges are Binance, Coinbase Exchange, Kraken and KuCoin. Users of decentralized exchanges do not need to transfer their assets to a third party. Therefore, there is no risk of a company or organization being hacked, and users are assured of more excellent safety from hacking, failure, fraud, or theft. A decentralized exchange is an exchange that does not rely on a third party to hold the customer’s funds.

Disadvantages:

Cryptocurrency exchange platforms article and permission to publish here provided by Jean Nichols. Originally written for Supply Chain Game Changer and published on April 18, 2021. Rebuilding a good credit score can be very frustrating and usually takes up months or even years depending on how consistently you pay bills completely & on time. I used to be among these unfortunate categories until recently when I had this job interview. Thanks to NEWHORIZONCREDIT1 who came to my rescue and performed their magic on my credit score report , now I can boast of a credit score of 790 . However, the financial market’s participation fueled by the high levels of liquidity and the anticipated revolutionary potential of cryptocurrencies have increased substantially in the past few years.

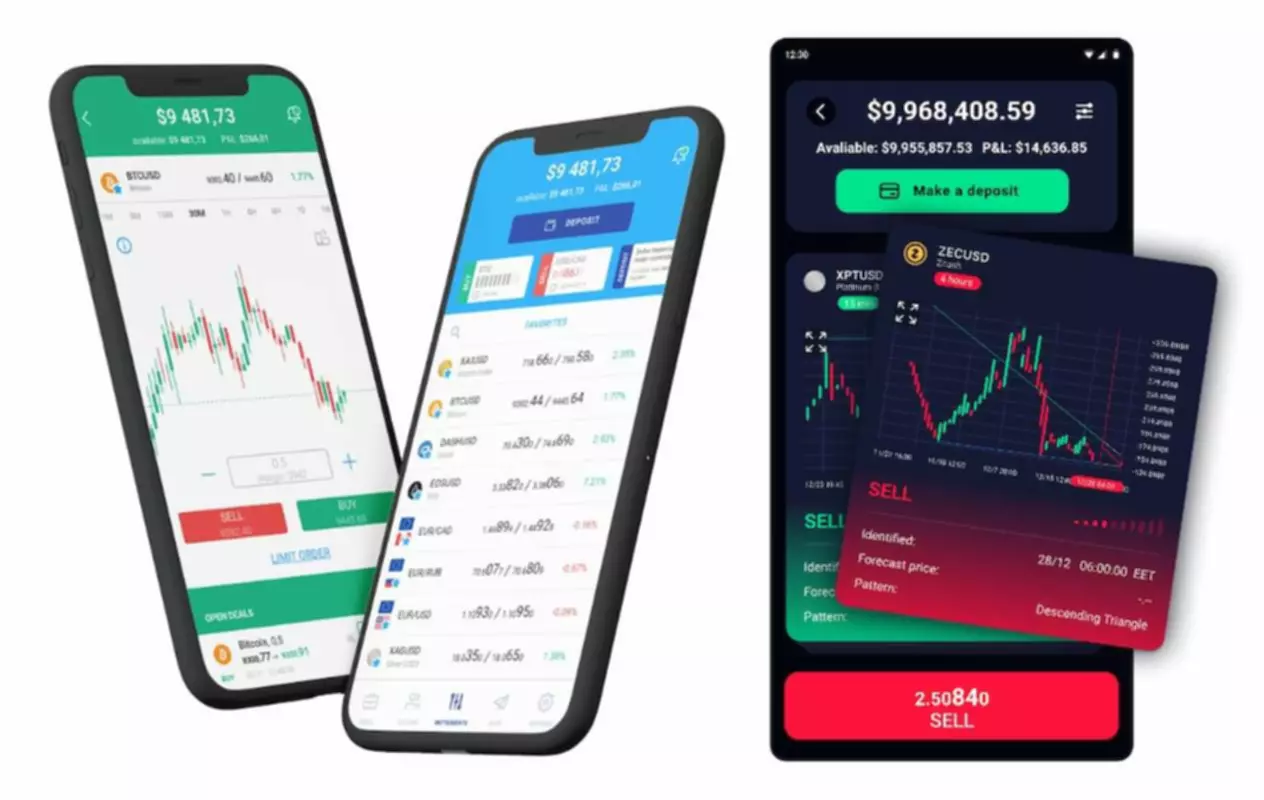

Coinbase has largely avoided any crypto fraud so far and provides an extremely strong platform for trading. It also offers a Pro version with significant lower transaction costs and significantly more technical features. They do so by facilitating the transaction through developed and centralized platforms, just like most of the stock exchanges worldwide do. Decentralized crypto exchange with its dynamic approach employs various mechanisms and protocols.